47+ how to get a mortgage if you are self employed

Web Determine your net profit for the previous two years using your tax return. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Can You Get A Mortgage If You Re Self Employed Mortgages And Advice U S News

Ad Get Preapproved Compare Loans Calculate Payments - All Online.

. Web Clean up your balance sheet. A Director of a Company. Web Get credit ready At least a year before you know you will want to buy a house check your credit score.

Most lenders will require at least two years of bank statements to prove your repayment capability. Web Self-employed and struggling to get a mortgage loan. Web With that in mind here are a few tips to help you get approved for a mortgageeven if youre your own boss.

Since lenders hold freelancers to a higher standard you really have no choice but to get your financial affairs in pristine shape. Web Being classed as self employed for lending purposes usually includes being. Set A Budget Know What You Can Afford.

If you want to begin the mortgage process youll need to collect the personal and business financial information. Compare Now Find The Lowest Rate. When you apply for a mortgage as a self-employed.

Enter the mortgage application process as prepared as possible. This is especially important when you apply for mortgages for. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Ad Prequalify for a mortgage even if you just started working for yourself. Keep tax deductions to a minimum. Additional reasons why self-employment may make it.

Improve your credit score and correct any errors on your. Web 30-year mortgage refinance increases 015. Web Typical eligibility requirements to get a mortgage include.

Quontics mortgages are a great option for borrowers with alternative income documentation. Quontics mortgages are a great option for borrowers with alternative income documentation. Web This can make it more difficult to prove steady income which can impact your chances of being approved for a mortgage.

Try bank statement loans. We base loan approval on your deposits. Web Being self-employed has many benefits.

Serious About Finding Your Next Home. Divide the sum by 24 to find your average monthly. You get to set your own hours decide what work you want to take on and operate on your own terms.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Get Instantly Matched With Your Ideal Mortgage Lender. Web To qualify for the lowest mortgage interest rate possible as self-employed borrower follow these tips.

Any borrower needs to provide extensive documentation of income. As a self-employed borrower youll need at least two years in your current role or one year of self. Web This means you will have to apply for a mortgage in the same way as everyone else.

Discover The Answers You Need Here. Web Documents Required For A Self-Employed Mortgage Loan. Web Yes you can get a mortgage with bank statements.

Web Getting a mortgage is best not left to spur of the moment especially if youre self-employed so its a good idea to get pre-qualified for your loan. In theory you should have access to the same mortgage deals and you. Web In 2021 this loan amount limit ranged from 548250 to 822375.

Web Provide thorough financial records. The average 30-year fixed-refinance rate is 692 percent up 15 basis points compared with a week ago. A Director of a.

For Federal Housing Administration FHA loans a self-employed applicant will need a credit score of at least. Dont take too many deductions. If you know youll be applying for a mortgage in the next two years reduce the number of tax deductions.

The good news is. Equifax Experian or TransUnion are the main ones. Start The Application Process Today.

Add each years net profit together. The longer the deposits the better. Web Requirements for VA mortgages are also fairly lenient.

Web Required Documents for the Self-employed. One final tip for the self-employed. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes.

At least 2 years employment history self-employment history in this case A credit score of at least 580. Ad Prequalify for a mortgage even if you just started working for yourself. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Ad PNC Offers A Wide Range of Mortgage Options.

Can You Get A Mortgage If You Re Self Employed Mortgages And Advice U S News

5 Tips For First Time Home Buyers What I Wish I Had Known

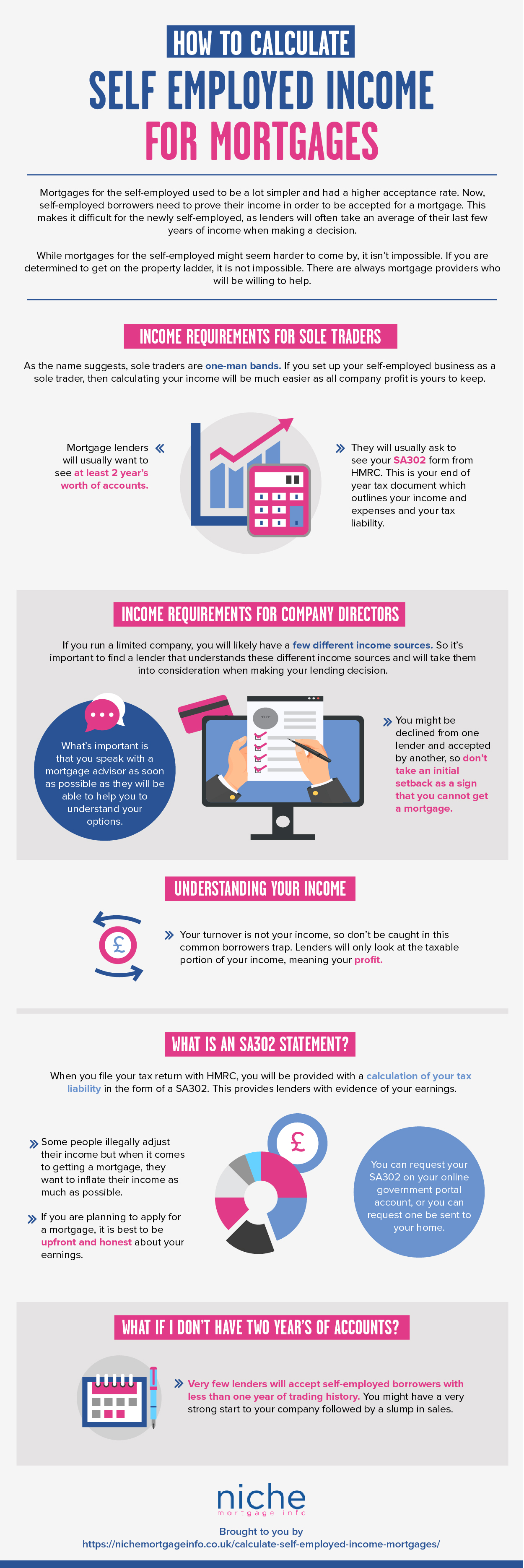

Mortgage Lenders Income Requirements For The Self Employed Niche

Free 3 Self Employment Sworn Statement Samples In Pdf Doc

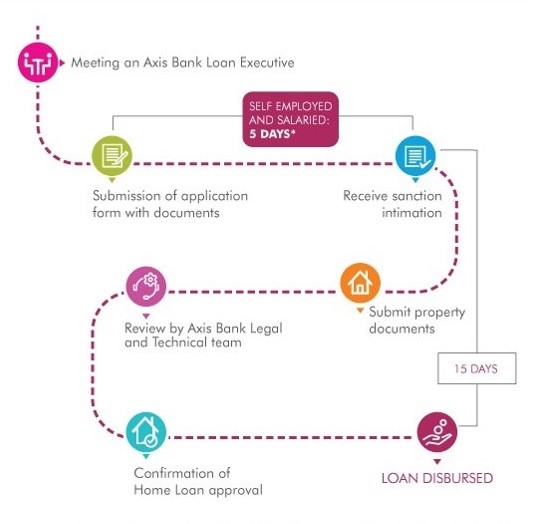

Home Loan Balance Transfer All You Need To Know

Free 3 Self Employment Sworn Statement Samples In Pdf Doc

How To Get A Mortgage When You Re Self Employed Find My Way Home

Tips For Applying For A Mortgage If You Re Self Employed Taxassist Accountants

How To Get A Mortgage If You Re Self Employed A Small Business Owner Or Gig Worker Mybanktracker

Self Employed Mortgages Guide Moneysupermarket

How To Get A Mortgage When You Re Self Employed Tide Business

How Much Mortgage Can You Afford If You Re Self Employed Embrace Home Loans

How Much Mortgage Can You Afford If You Re Self Employed Embrace Home Loans

5 Things You Did Not Know About Personal Loan Axis Bank

How To Get A Mortgage When You Re Self Employed Rocket Mortgage

How To Qualify For A Mortgage If You Re Self Employed 2020 Niche

Free 3 Self Employment Sworn Statement Samples In Pdf Doc